I led the creation of a successful MVP for a SaaS company that improved inventory management and access to products and services, resulting in faster payment confirmation and order fulfilment for clients.

About Jumbleng

Jumble is an online platform that enables businesses to connect with other businesses for trade, manage their supply chain, inventory, invoices etc.

Smoothing out the flow: Conquering payment challenge

- Security Concerns: Nigerian merchants fear delays and extra compliance burden with online payment processors compared to trusted banks.thiis addressed this by offering a system although a bit manual, including integrations with trusted, established banks. This allows merchants to choose a system they’re comfortable with.

- Cost Barriers: High licensing fees and infrastructure costs prevented Jumbleng from creating their online payment processing gateway. umbleng bypassed gateway costs by integrating with banks’ APIs for seamless merchant transactions.

Feature goals

- Streamline transactions: Enhance the buying and order fulfillment process for both buyers and sellers.

- Enhanced Transparency: Ensure users can clearly understand the payment status at all stages of the transaction based on user testing.

Understanding the Existing Landscape:

To understand the existing landscape, I started by mapping the traditional payment process for merchants :

- Receive Invoice: The merchant receives an invoice for their order.

- Initiate Payment: The merchant initiates the payment process, by going to the bank.

- Physical Payment: Depending on their preference, the merchant may use a teller slip, write a check, or deposit cash.

- Payment Confirmation: Some merchants may choose to contact the vendor to inform them of the payment.

- Wait for Order Fulfillment: The merchant waits for the vendor to confirm receipt of payment and fulfill the order.

Designing a seamless flow

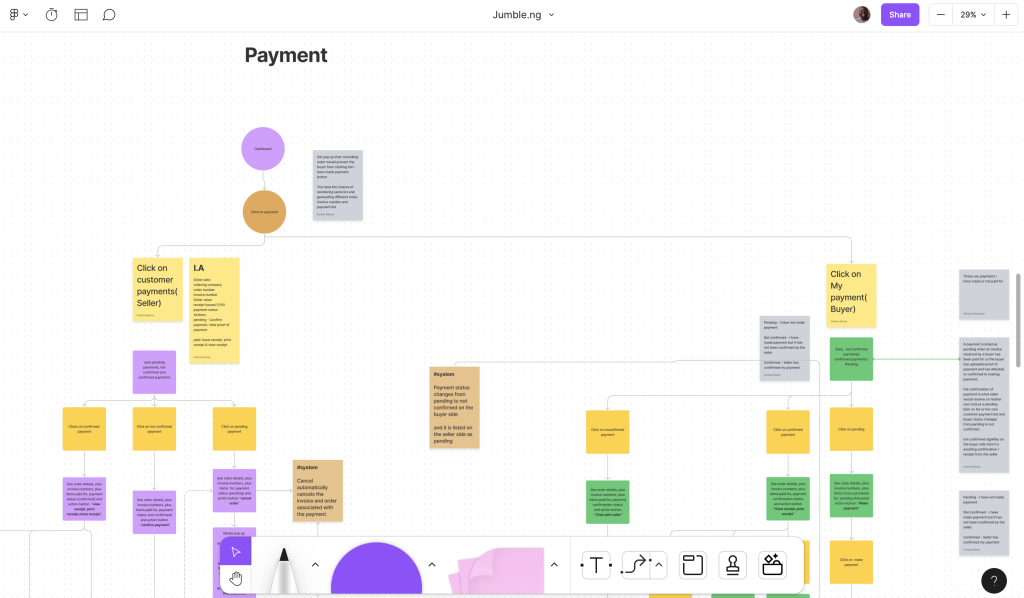

With these insights, I embarked on mapping a user flow that would streamline the transaction process with Jumble. This flow would encompass:

- Integration with Bank Accounts: Ensuring secure and seamless integration with various bank accounts for receiving payments.

- Vendor Communication: Establishing clear communication channels to keep vendors informed about payment status and facilitate smooth order fulfillment.

- Frictionless Transactions: Designing a user journey that minimizes friction for both merchants and buyers, ultimately leading to successful and smooth transactions.

Visual flow

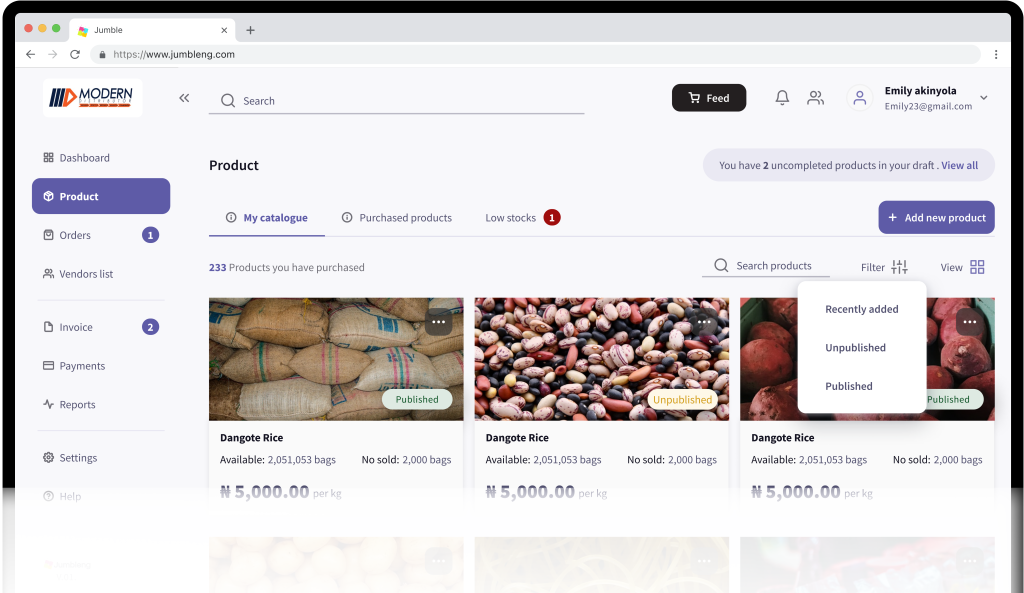

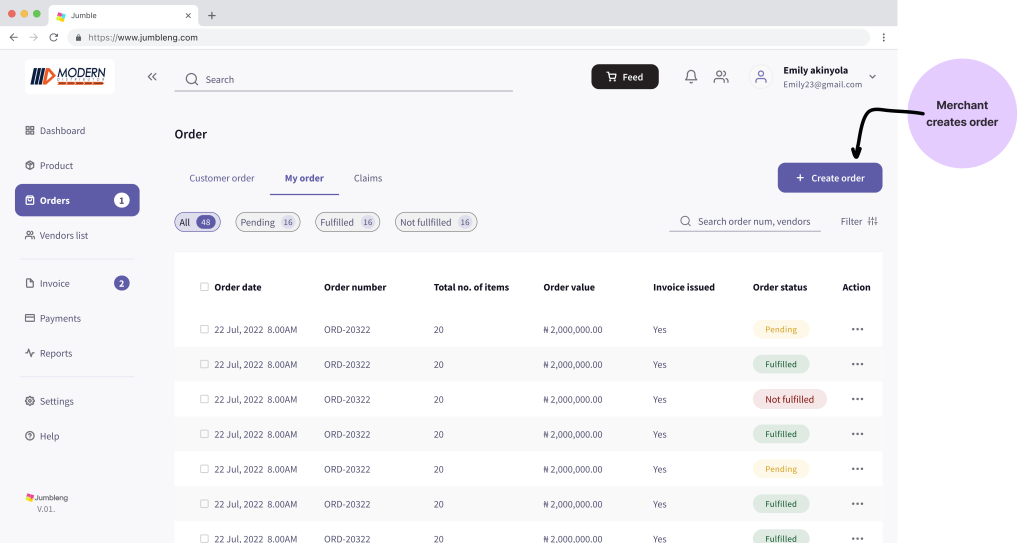

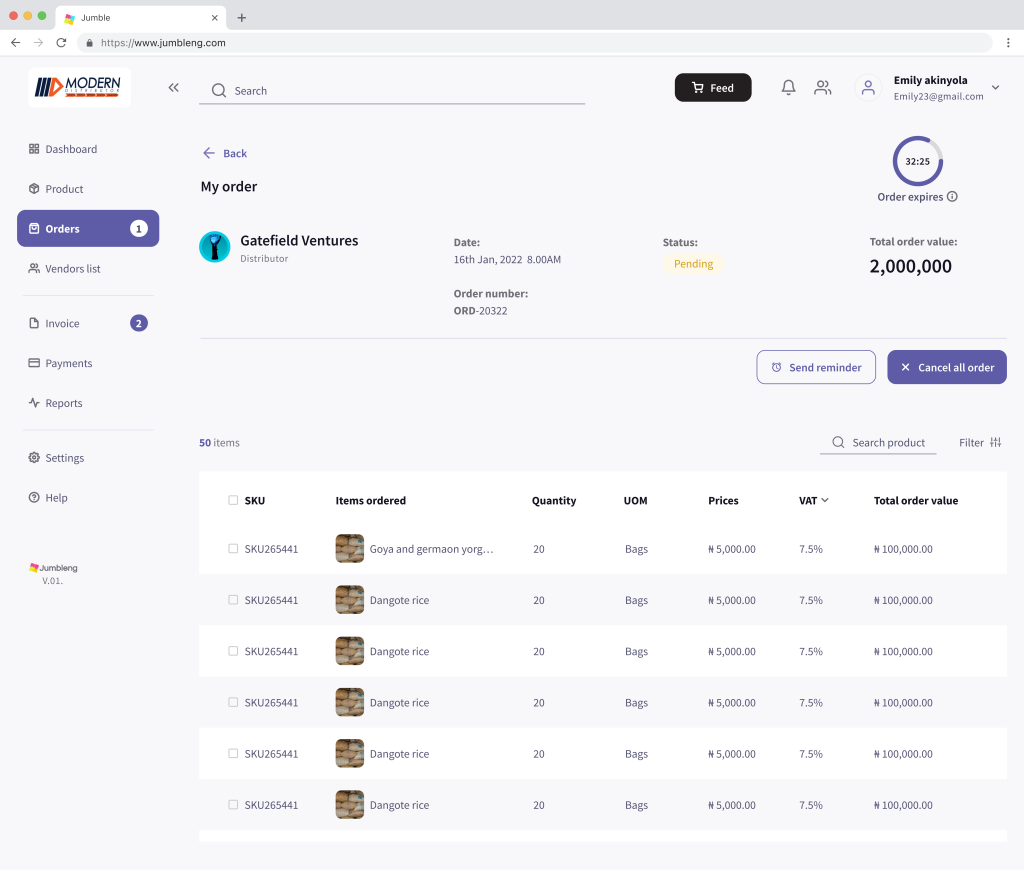

Merchant creates an order

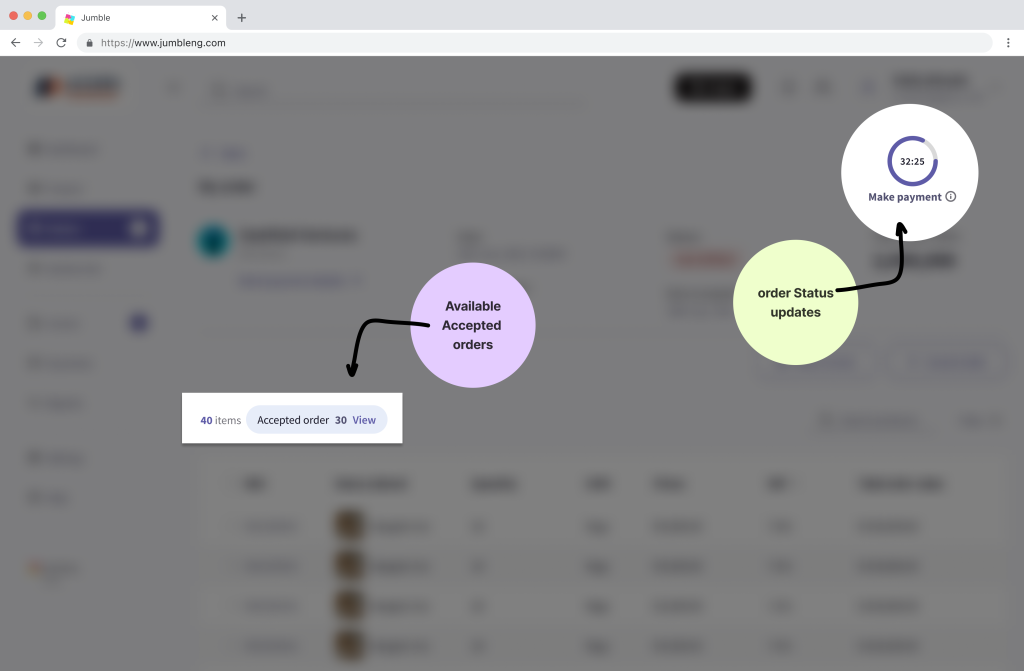

Order status

Orders display ‘Pending’ with a countdown timer for vendor fulfillment, creating urgency and reducing delays for both buyers and sellers.”

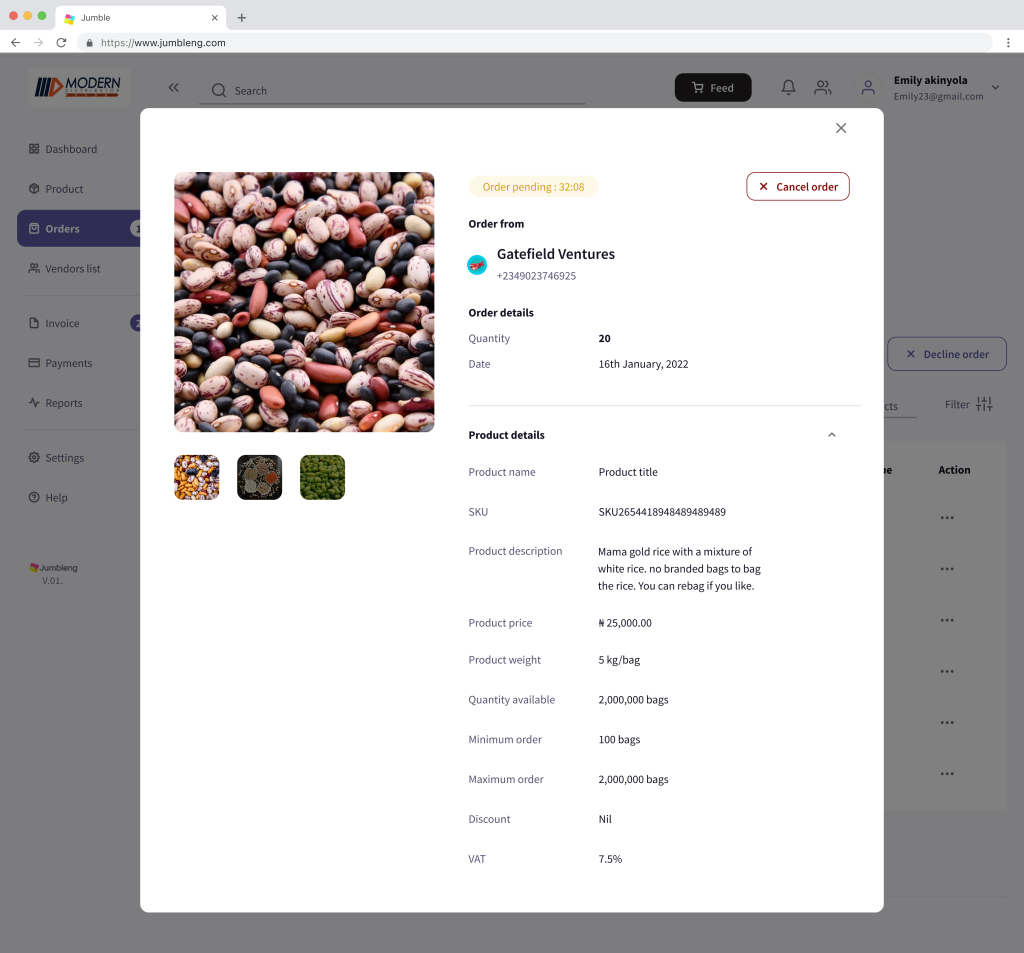

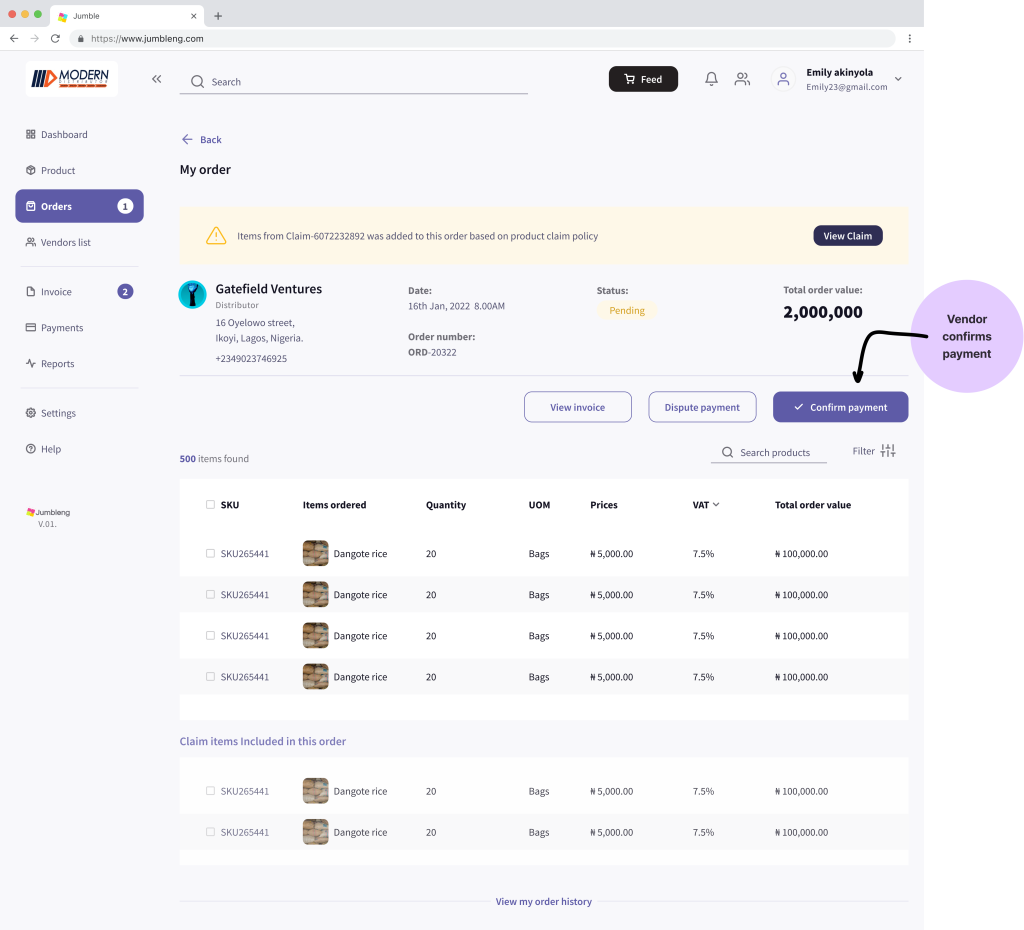

Single product order detail

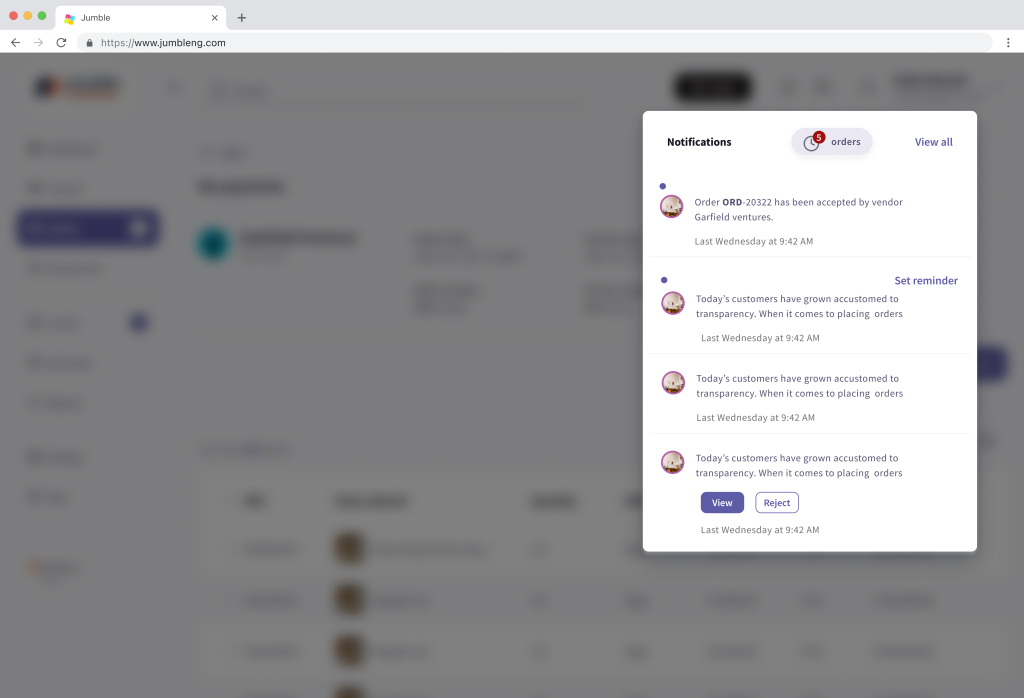

Alerts for order status: Merchants are kept informed about order acceptance through alerts.

Payment triggered: Vendor confirmation allows merchants to proceed to make payment.

Merchant proceeds to go to the bank to make payment.

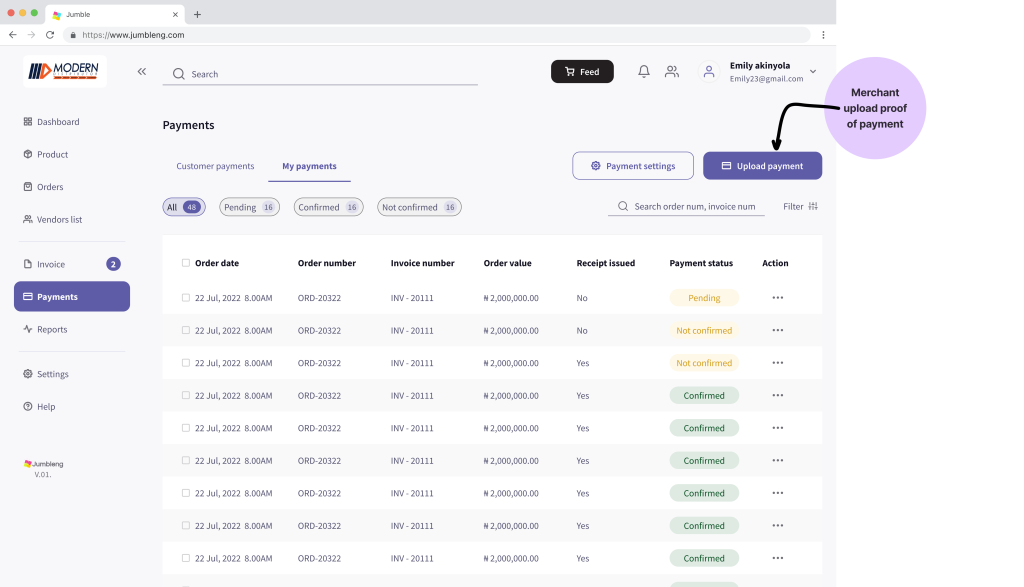

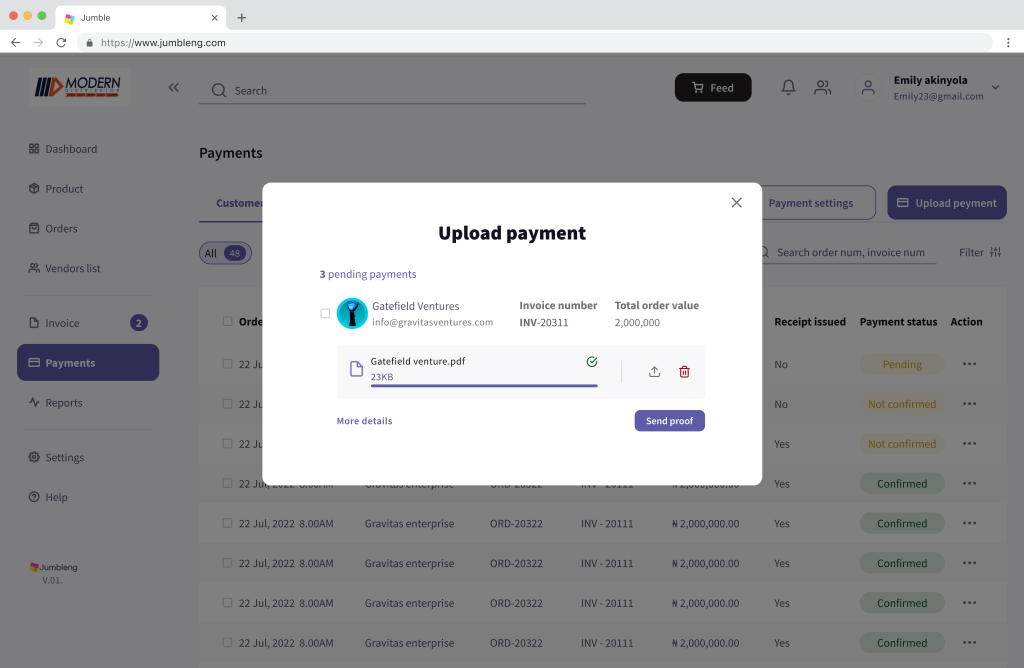

Following payment at the bank, merchants can conveniently upload proof of payment via the Jumble dashboard.

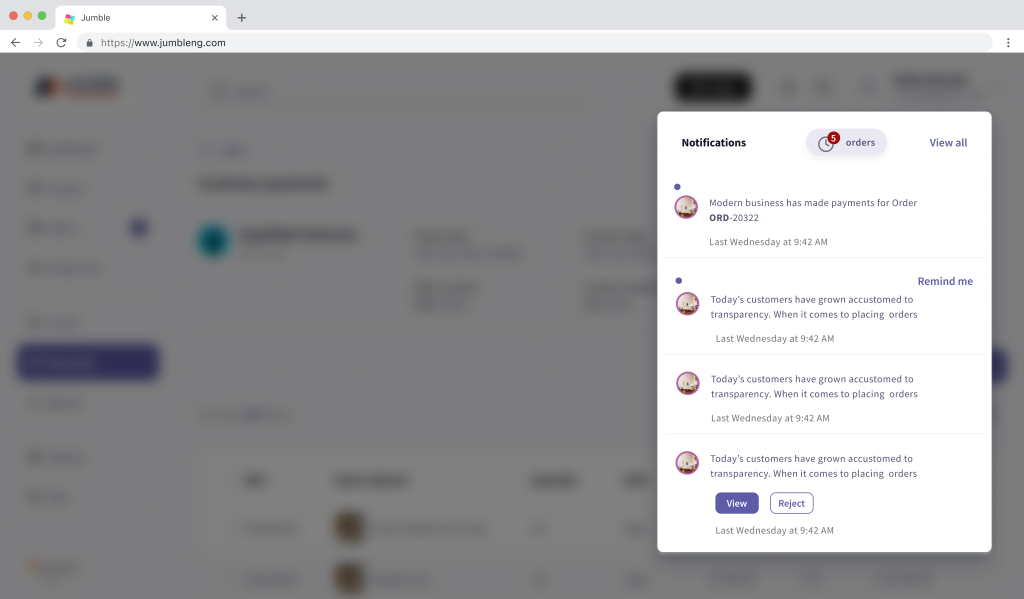

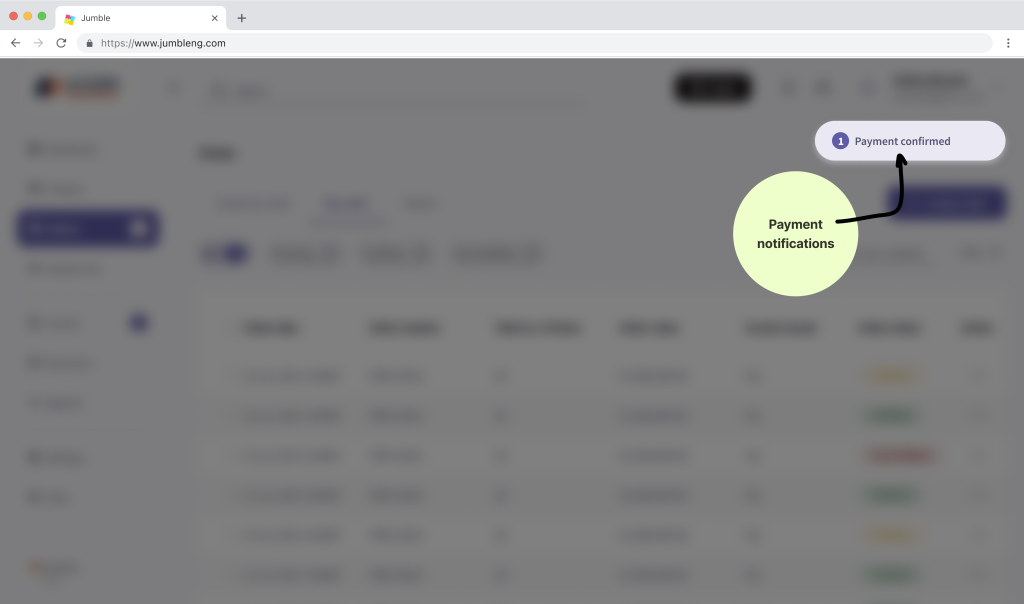

Vendor gets notification of payment

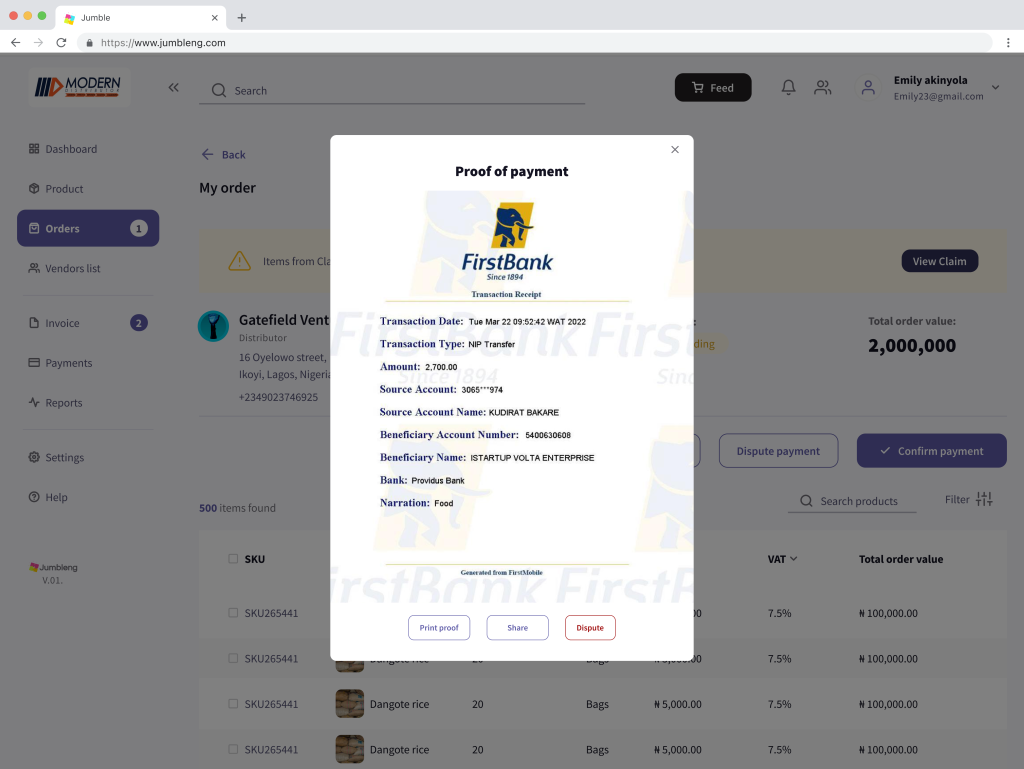

Proof of payment

Vendor confiirms payment

Merchant gets status notification

Personal take aways

- Adapting to Evolving Needs: As Jumble grows, the payment process might need to adapt to accommodate new user types or business models. This project encouraged me solidify the importance of designing for adaptability of present constraints while being opened for future iteration.

- Balancing User Needs with Platform Requirements: The design choices, like allowing proof of payment upload after checkout, likely involved balancing user convenience with platform security needs. This project helped me to highlight the importance of navigating such trade-offs effectively.