Problem statement

An average of 3 – 7 customers were sending money to the wrong accounts every week costing the business several thousand dollars in chargebacks

Identifying why this problem exists.

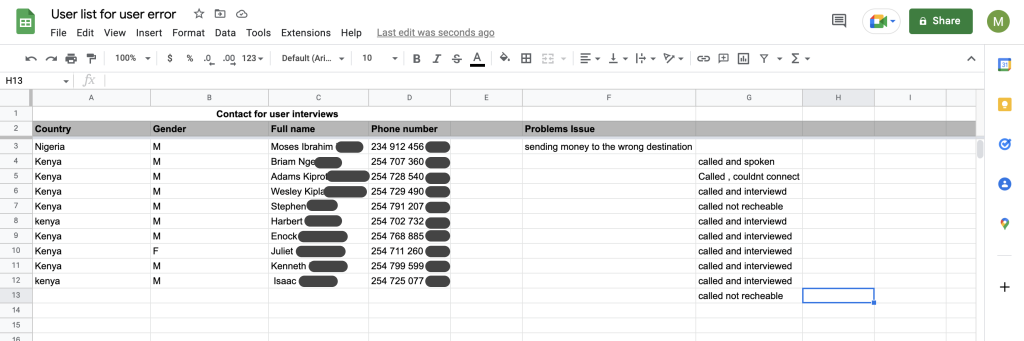

To understand why we were having this problem out of the blues, I spoke to customer service to find out

- How often these errors happened with our customers.

- What regions/countries they happened – since we operate a multi-currency platform with users from different parts of the world.

Phone calls with users

Insights from the interviews

*Each call lasted between 3 minutes to 15 minutes

- Customers only realised their error when the reciepient informs them of not receiving the money.

- Some users transacted less because of how frequent they experienced this error.

- This issue happened majorly on bank transfers.

- There was a bug in our payouts API, – When sending money to a particular bank (GC bank), on the final screen the bank was autoupdate to Polaris bank.

- The majority of the users were not new users.

- Users could flawlessly talk me through how they sent money

on the app

Measuring success

This part was very clear

- Reduce chargebacks from users making mistakes in sending money to zero dollars.

- Help customers from losing funds.

- Eliminate the time business spends to recover those funds.

Fixing the problem

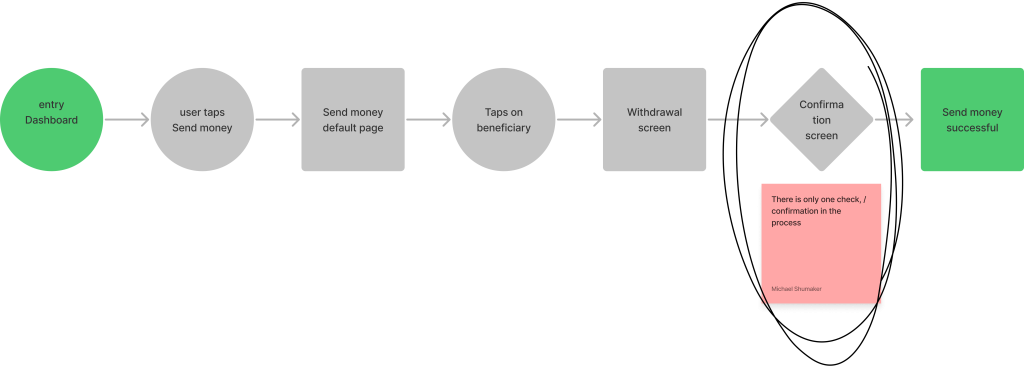

I took these findings to the team, highlighting the problem with the send money API

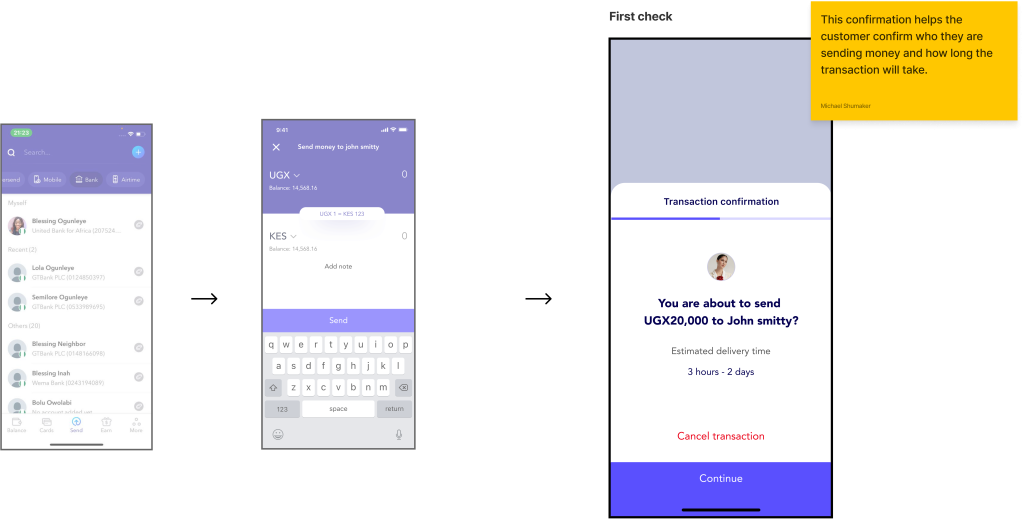

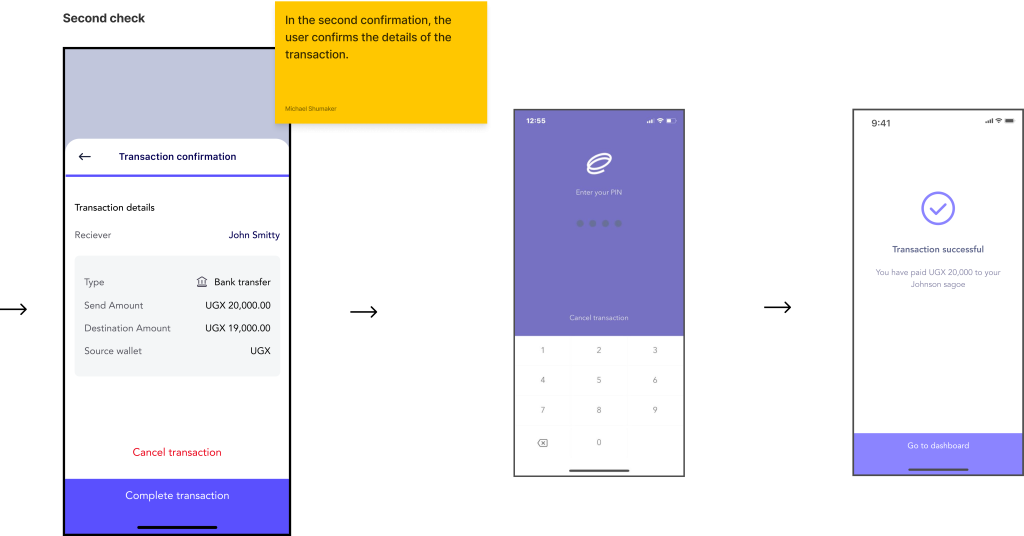

Redrawing the user flow diagram of how our send money to bank worked to really understand and highlight the key area that caused this issue in the user flow.

*For visual reference

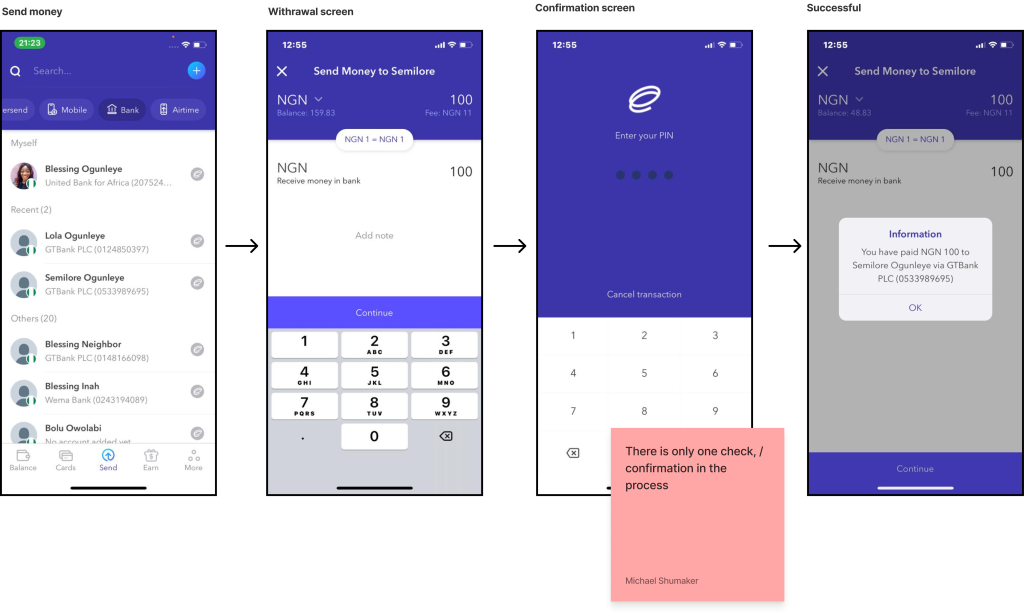

Fixing the problem:

Including needed checks

Results and takeaways

- Since implementing these fixes, we have not had any customer errors in sending money.

- Chargebacks have not happened as a result of customers sending money errors.

- Ideally, when we design flows or user experiences it is a common belief that enabling users to complete their task in the fastest way possible with the least amount of steps is the ideal way to go, this experience revealed to me that that isn’t always the case, and sometimes this might also be a problem.